Continuing from the previous post.

Life gives you lessons…

“Learning is a messy process and it hurts.”

Though I know there isn’t likely any successful investor today who hasn’t lost money (it’s part of the learning process), but I can’t help thinking if I had continued in the line of sustainable safe investments though, with low/moderate returns, I probably wouldn’t have lost a kobo. Maybe I’m still basking in my naivety that it’s possible to not lose money in the journey of financial freedom, but if capital preservation is the top priority, I think it’s possible. I mean, I did this for over seven years and didn’t lose a kobo.

I have reviewed what went wrong and taken notes.

I’m done with alternative investments in Nigeria (for the nearest future). Even if the company is healthy, Government regulation is one major risk factor that can and has disrupted so many businesses in various sectors of the economy. SEC has adversely impacted the agritech world negatively. What sucks is they bring out regulations but have no plans to help investors recover their monies if and when the companies fail. They go silent. What then is the use of having companies register with them if they are not actively safeguarding investor’s funds?

My major issue with alternative investment is that most times, you can smell disaster coming but there is little you can do on short notice to avoid it. My constant monitoring of the agritech company made me see red flags recently. I alerted everyone who I introduced to it that I was going to start divesting. I have learned never to invest in instruments where I have no form of control over my funds. I saw what was coming, but as most alternative investments go, there is no room for immediate pre-liquidation.

Instead of working with percentages, I will henceforth appropriate maximum amounts to each instrument; amounts I’m comfortable losing. Percentages don’t give a true picture. If I had focused on real numbers, I think I would have listened more to the ringing alarm that I will lose a huge amount of money soon.

I’m also going to do my thing on the low. I’m not a portfolio manager neither am I an investment tutor. It’s funny how all the years I was running my show quietly, I didn’t encounter loss. But the year I tried to share knowledge with friends and colleagues and even extended this to my folks, it’s the year I have seen so much loss. Though no one blames me, I feel guilty.

It’s back to the basics for me, back to the drawing board. I have been humbled. I’ll be going back to learning about personal finance and investments. I’m taking a long hiatus from actively investing. Seeing posts about money now leaves a sour taste in my being these days. I’m taking time off to heal and fully recover till it no longer hurts. I’m taking my time to observe two investment clubs and will, later on, decide on which to join, but no active participation just yet. My watchwords now are – the financial freedom path is not a sprint but a marathon.

Life shows you just how strong you are…

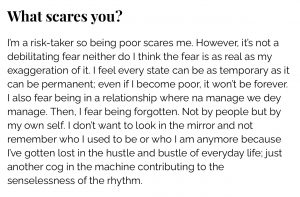

I took this excerpt off a Nairalife interview on Zikiko. I resonate well with it. I guess that which I feared has come to pass, but I’m living through it. I have gone to the lowest of lows and I’m finding my way back up. Slowly, but its progress.

“And I’ll rise up

I’ll rise like the day

I’ll rise up

I’ll rise unafraid

I’ll rise up

And I’ll do it a thousand times again” – Rise up (Andra Day)

I’m still taking notes, still learning, and making sure the lessons are sticking.

While there is a good chance of repayment on the agritech investment, I have chosen not to dwell too much on the hope of recovery. If they pay fine, if they don’t, all good still. I’m not ready to have my heart broken twice by them (hope is a dangerous thing to have).

It feels like my boujee life has been taken from me. I enjoyed the most robust cash flow since the beginning of the year till disaster struck. I felt like I had made it and the future looked set. Now I’m technically broke.

I was on a roll, but life has pressed pause. I’m not fighting it or rushing to recoup the money. I’m starting afresh sort of. I don’t know how long it will take, but I’m going to be patient with the process.

Like Henry says, it’s time for aggressive savings. I’m trying to cut down on my expenses and adjust my lifestyle. Reward asked me a vital question which I too had pondered on. He asked if this will affect my embarking on a gap year soon. Truth is, it might (most likely). I hope to live the gap year exploring and traveling. More than that, I want to gift myself time.

“Call it what you want… this year of a pause.

We call it the raising of a man.

His reconnection to a boy that society pushed too hard in one direction.

The space to rediscover his center away from the box of extremes.

We call it a growth year. Sometimes we pause for growth.

It doesn’t mean you’re behind or struggling… it means you’re growing.

To allow that to happen, sometimes it just means creating a space with no intended path.

That’s where we are my sweet boy man.

We are just being right now.

You can breathe.

You can learn about you.

You can experience and strive and research and pay attention in this moment.

You have been gifted this time to BE so that you may then find your passion to DO.” Excerpt from Gap Year or Growth Year? by the The Good Men Project

I had hoped by the set time for the gap year I would have saved up a certain amount. Even if I’m not at that minimum amount to live freely, I just might take a leap and do with whatever I have, and go from there. Figure out a plan and adjust expenses accordingly.

Or I might have to work some extra years to cover up the shortfall if I don’t want to compromise on the quality of life I hope for during the gap year. Well, when I get to that bridge I will cross it. I don’t know the future; things might even turn out way better for me and I’ll have much more than I hope for. That’s how life goes, so I’m taking it one day at a time.

This is a restart. This is me not allowing life break me. This is me choosing to be happy.

It’s just money.

We move.

Comments 1

You sound like you are well educated on investment theory but I am still going to say this for the benefit of others who are reading. If your goal is sustainable and steady growth of your investment, you cannot stick to just basic investments (money markets and fixed income) but you should spread across all asset classes including yes, alternative investments. However, you must be cautious of the amounts allocated to them. From my training, for someone between 30-40 with life expectancy of 60-70, it makes sense to put 5-10% of networth in alternative investments. And even within the range of alternative investments (private businesses, peer to peer lending, cryptocurrencies, crowdfunding), you still have to diversify. In other words, while putting the 5% in alternative investments, you might want to split between 3 alternatives (1% on bitcoin, 2% in peer to peer lending, 2% in agritech).